Another quick hit, as I prepare content for the soon-to-be launched blog on Artesian Media. This one has to do with a “killer app” that already is a big hit in the rest of the world, but that has yet to take off here in the U.S.

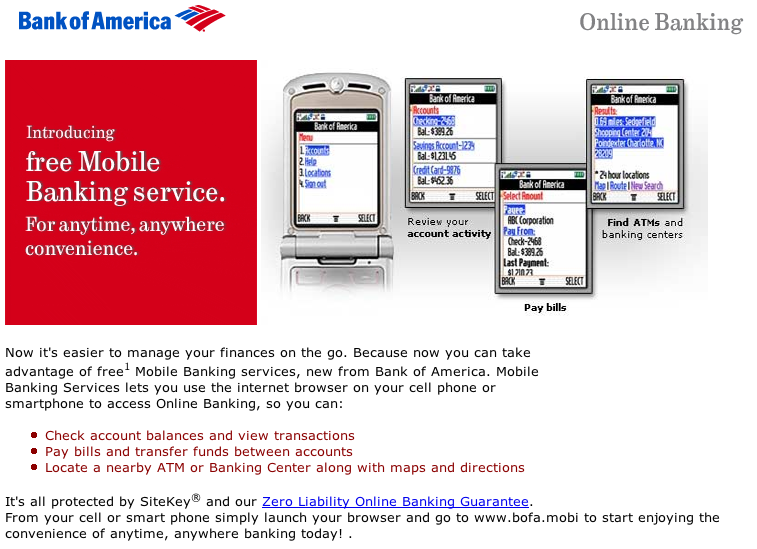

Last week, one of the more interesting announced capabilities of Android/Gphone was the ability to form Secure Socket Layer (SSL) data connections. They billed it as a way that the Home Office can send secure data to its salesforce, or that users can securely share data with each other’s handsets, but … the first thing I thought of was that it would allow us all to access our bank accounts/credit cards/401(k)s from on our cellphones. Personally, I think it’s a useful app, but one that gives me the creeps, because for some reason I worry more about typing in the password to my bank account on my cellphone than I do on a desktop computer connected via broadband.

Why would that be, I wonder…? Hmmm… I’ll think of it in a moment.

Well, Cnet is kinda dousing this idea with a bucket of cold Reality Water.

But despite the fact that there are many options and opportunities for cell phone subscribers to access their banking information and pay their bills on their mobile phones, the uptake for these applications and services has been pretty weak. According to Forrester Research, only about 3 percent of mobile subscribers in North America check financial accounts on their mobile phone at least once a month. This rate of adoption is lower than that of services like music downloading, which 5 percent of mobile users say they do at least once monthly.

“Mobile banking and bill payment has been available for a while now,” said Charles Golvin, a senior analyst at Forrester Research. “But it has yet to set the world on fire.”

In Third World countries, where a trip to the bank is kinda like tying pork chops to your torso and swimming through a crocodile pit, the prospect of being able to handle banking & money transactions without having to brave the cordons of thieves, muggers, kidnappers & encyclopedia salesmen that ring banks, looking for people with fat wallets, is a good one. I have to say, back when I was the managing editor of the Caracas Daily Journal, the locals in the print shop used to warn me not to carry my paycheck openly to the bank to cash it, because “ladrones y asesinos” were lurking in the streets, looking for the telltale business envelopes in people’s hands. Especially big, dumb gringoes like me … although, I have to say, if anyone were looking for a likely mark to shake down, I don’t think an envelope in my hand or not would really make that much of a difference.

Anyway – we have long used the difference in online banking in Brazil, as contrasted with the U.S., as a teaching tool in our New Media training sessions. The point of the exercise is not to dwell on how much banks in other countries are f’d up, as compared to the U.S., but to think about how a digital, online solution to a problem can be specific to a single market, or market condition. Viz:

Besides the convenience factor, another reason mobile banking hasn’t take off is that there are few compelling reasons to access bank or bill-paying information on a mobile phone when most people in the U.S. have easy access to a computer. With overdraft protection, automatic bill paying, and convenient and easy access to ATM cash machines, most people don’t need up-to-the minute check balance information, nor do they need to be able to pay bills while walking around town.

Technorati Tags: mobile banking, Google Android, SSL connections

David, I think mobile banking is just the enabling technology for a far more promising application. Mobile purchasing. over 10 years ago I had a phone that would hold a full size smart card within the phone. The card was even connected to the phone for the sake of debiting the account when the phone’s owner made a purchase. A decade later, the idea of making a phone big enough (read: thick enough) to store a full size credit card in it sounds absurd. So, how do we advance the ability to pay for a transaction using my phone, without storing all of my physical credit cards in it? The key is that I don’t. Credit cards are just fancy keys to my financial records at any number of banks and credit institutions. Why not take advantage of the almost ubiquitous wireless data networks and use the phone to access the financial records directly. If my phone can access my banking information in order to debit last weeks groceries, or yesterdays music download, why not give its owner access to the same accounts.

Mobile banking is to mobile purchasing as the road is to the car. Without the first, the second is pretty useless.

Some projects of note:

Nokia and CitiBank are testing NFC (Near Field Communications, a sort of RFID for cell phones and payment systems) purchasing in NYC.

Research In Motion (the makers of the BlackBerry) just launched BlackBerry Wallet. It securely stores your account information in the phone and can be accessed automatically when you make online purchases with your device.

The “super smartcard” I worked on in 1986 will finally see the light of day in a thicker, heavier, more powerful and more connected device, your cell phone.

Mark